south st paul mn sales tax rate

Corporate Income Tax Personal Income Tax Unemployment Compensation Sales. Zip4 Enter a nine-digit ZIP code.

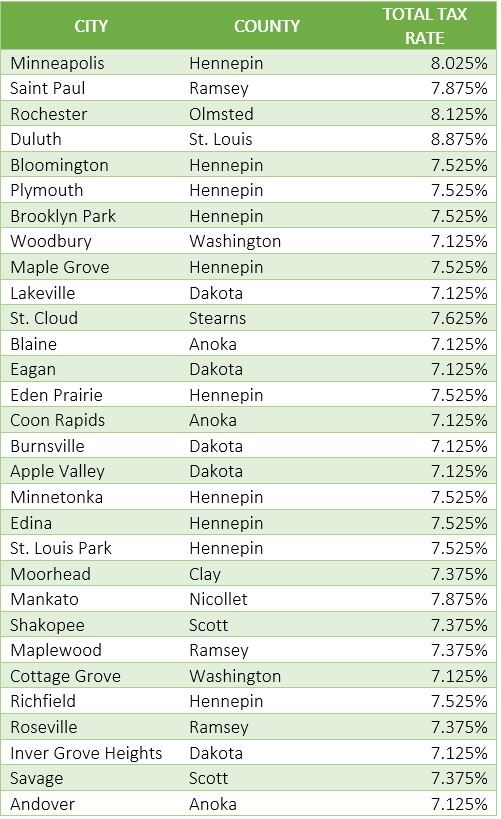

Minnesota Sales Tax Rates By City County 2022

The minimum combined 2022 sales tax rate for Hennepin County Minnesota is.

. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. Up to 890. 4 rows South Saint Paul.

The Hennepin County sales tax rate is. There is no applicable county tax. While many other states allow counties and other localities to collect a local option sales tax Minnesota does not permit local sales taxes to be collected.

See details for 157 23rd Avenue S South Saint Paul MN 55075 Multi-family 6 bed 3 bath 3050 sq ft 450000 MLS 6230499. South Saint Paul is located within Dakota County Minnesota. The County sales tax rate is.

010 - 050 New Employers. The sales tax jurisdiction name is Minneapolis Downtown Taxing District Sp which may refer to. River Heights Chamber of Commerce.

The Minneapolis sales tax rate is. On January 1 2000 the 050 local option sales and use tax was implemented within the City of Saint Paul to fund the Sales Tax Revitalization STAR program. The 2018 United States Supreme Court decision in South Dakota v.

This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates. Download all Minnesota sales tax rates by zip code.

Welcome to 157159 23rd Ave S located in a convenient and quiet residential neighborhood in Dakota County. See reviews photos directions phone numbers and more for Sales Tax Rate locations in South Saint Paul MN. Sales Tax Rate Calculator.

The sales tax rate does not vary based on zip code. The Saint Paul Minnesota sales tax is 688 the same as the Minnesota state sales tax. What is the sales tax rate in Minneapolis Minnesota.

The current total local sales tax rate in South. This includes the rates on the state county city and special levels. This tax is in addition to the sales taxes collected by the State of Minnesota and Dakota County.

Paul Local Sales Tax will be collected through December 31 2040. You can print a 7875 sales tax table here. 6875 Transit Improvement Tax.

A composite rate will produce anticipated total tax receipts and also generate your bills total. Individual Income Tax Statistics. The December 2020 total local sales tax.

Individual Income Tax Statistics. The West Saint Paul Minnesota sales tax is 713 consisting of 688 Minnesota state sales tax and 025 West Saint Paul local sales taxesThe local sales tax consists of a 025 special district sales tax used to fund transportation districts local attractions etc. To review the rules in Minnesota.

This is the total of state county and city sales tax rates. The average cumulative sales tax rate in South Saint Paul Minnesota is 713. The December 2020 total local sales tax rate was also 7125.

144 or 834 Employers with Experience Rating. Paul MN 55075 Phone. Who Decided to Implement this tax.

Within South Saint Paul there is 1 zip code with the most populous zip code being 55075. Within South Saint Paul there is 1 zip code with the most populous zip code being 55075. The Minnesota sales tax rate is currently.

The results do not include special local taxessuch as admissions entertainment liquor lodging and restaurant taxesthat may also apply. South Metro Fire Department. Westbound Interstate 494Wakota Bridge.

In this basic budgetary function county and local public administrators estimate yearly spending. Paul and every other in-county governmental taxing unit can now calculate needed tax rates because market worth totals have been recorded. The Minnesota state sales tax rate is 688 and the average MN sales tax after local surtaxes is 72.

Minnesota Income Tax Statistics by County. The Saint Paul Sales Tax is collected by the merchant on all qualifying sales made within Saint Paul. Property Tax Data and Statistics.

The 8025 sales tax rate in Minneapolis consists of 6875 Minnesota state sales tax 015 Hennepin County sales tax 05 Minneapolis tax and 05 Special tax. View More Recently Sold Homes. MN Sales Tax Rate.

Minnesota Sales and Use Tax Business Guide. Ad Automate Standardize Taxability on Sales and Purchase Transactions. 132 12th Ave S South Saint Paul MN 55075.

This spacious side-by-side duplex is easy to rent and cash flow instantly. 9800 of gross income. Has impacted many state nexus laws and sales tax collection requirements.

The 2018 United States Supreme Court decision in South Dakota v. 300000 Last Sold Price. What is the sales tax rate in Hennepin County.

Tax rates are provided by Avalara and updated monthly. Integrate Vertex seamlessly to the systems you already use. The current total local sales tax rate in Saint Paul MN is 7875.

City of South St. The minimum combined 2022 sales tax rate for South St Paul Minnesota is. Statistics and Annual.

4750 Brent Ave E Inver Grove Heights MN 55076. The South St Paul sales tax rate is. 3 rows The 7125 sales tax rate in South Saint Paul consists of 6875 Minnesota state sales.

There is no applicable county tax. Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure. The minimum combined 2022 sales tax rate for Minneapolis Minnesota is.

Look up 2022 sales tax rates for Saint Augusta Minnesota and surrounding areas. The Minnesota sales tax rate is currently. The Minnesota state sales tax rate is currently.

Saint Paul MN 55102 General Information. SOLD MAY 31 2022. Did South Dakota v.

The County sales tax rate is. South Haven MN Sales Tax Rate. The 7875 sales tax rate in Saint Paul consists of 6875 Minnesota state sales tax 05 Saint Paul tax and 05 Special tax.

It is close to public transportation stores restaurants and entertainment. South International Falls MN Sales Tax. Minnesota Historical Tax Rates.

Sales and Corporate Tax Statistics. Saint Paul MN Sales Tax Rate.

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

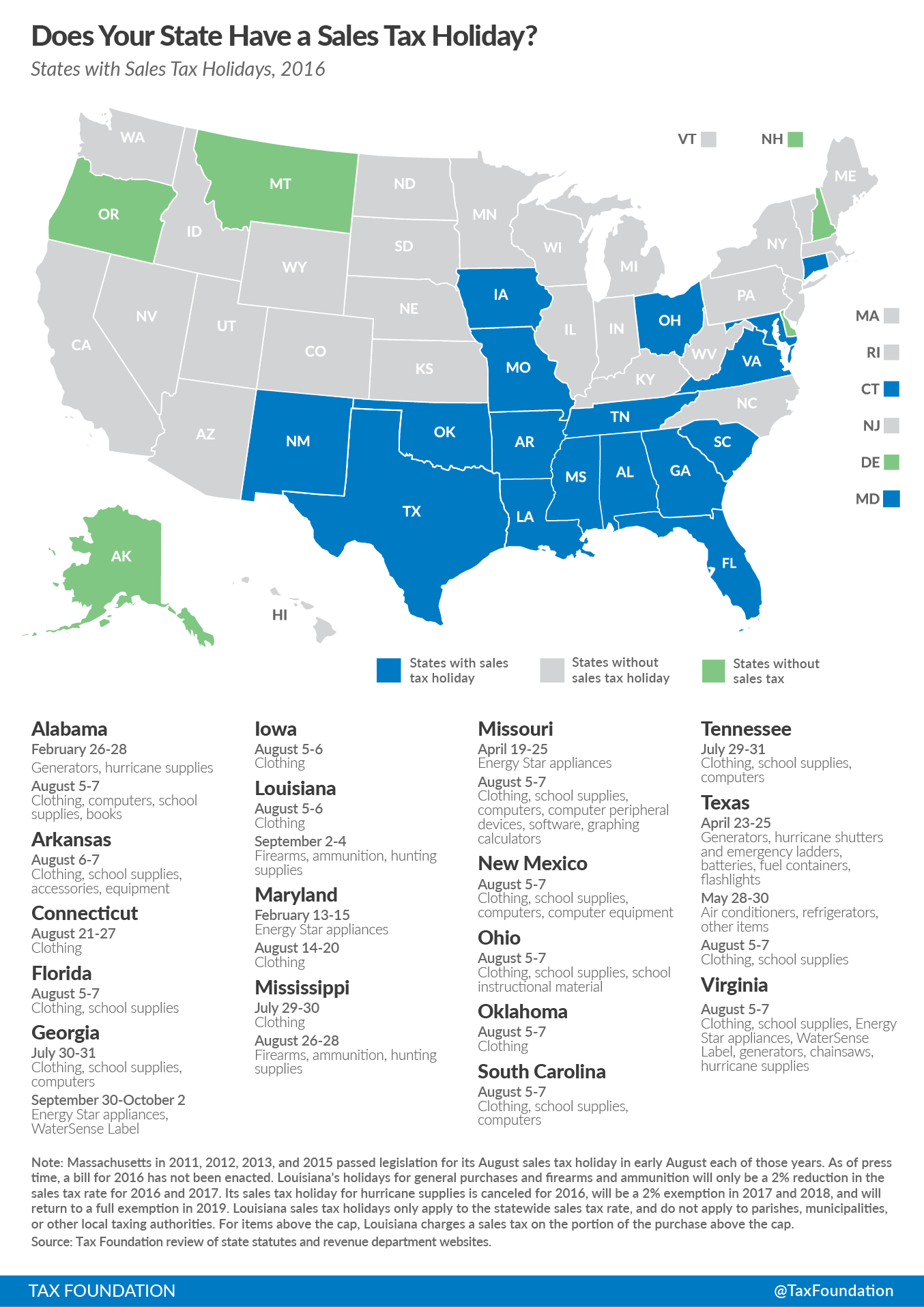

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Property Taxes By State Embrace Higher Property Taxes

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Kansas Sales Tax Rates By City County 2022

Historical Tennessee Tax Policy Information Ballotpedia

How High Are Capital Gains Taxes In Georgia Atlanta Business Chronicle

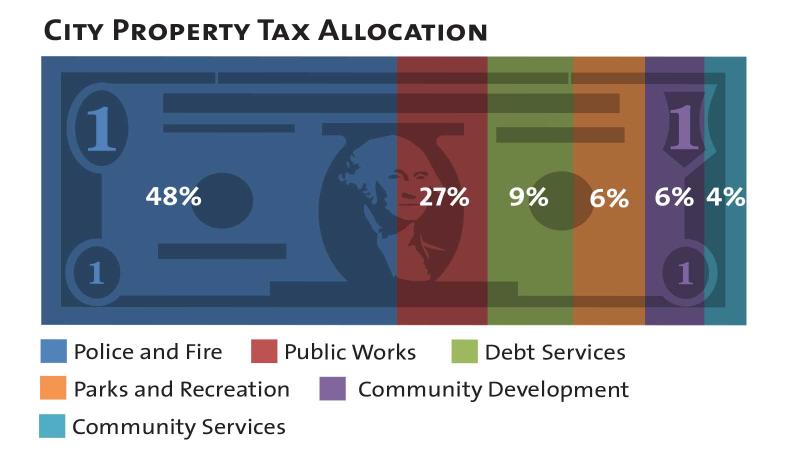

Council Approves 2022 Tax Levy City Of Bloomington Mn

Local Sales Tax Option Saint Peter Mn

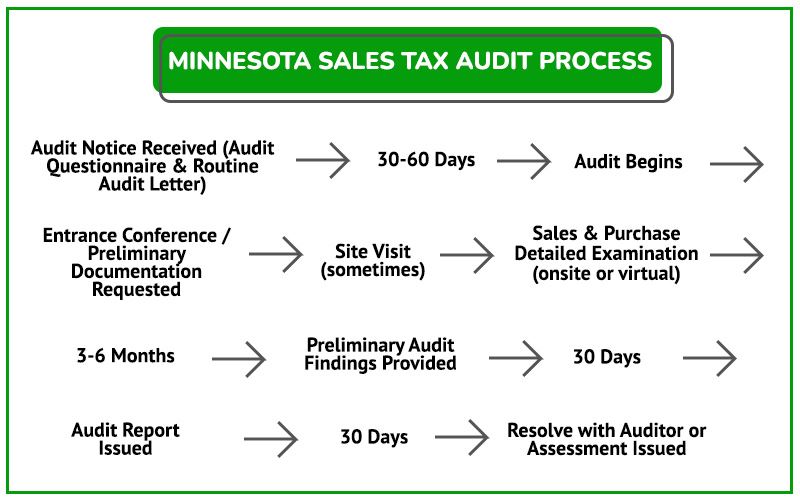

Minnesota Sales And Use Tax Audit Guide

Arkansas Sales Tax Rates By City County 2022

Local Sales Tax Option Saint Peter Mn

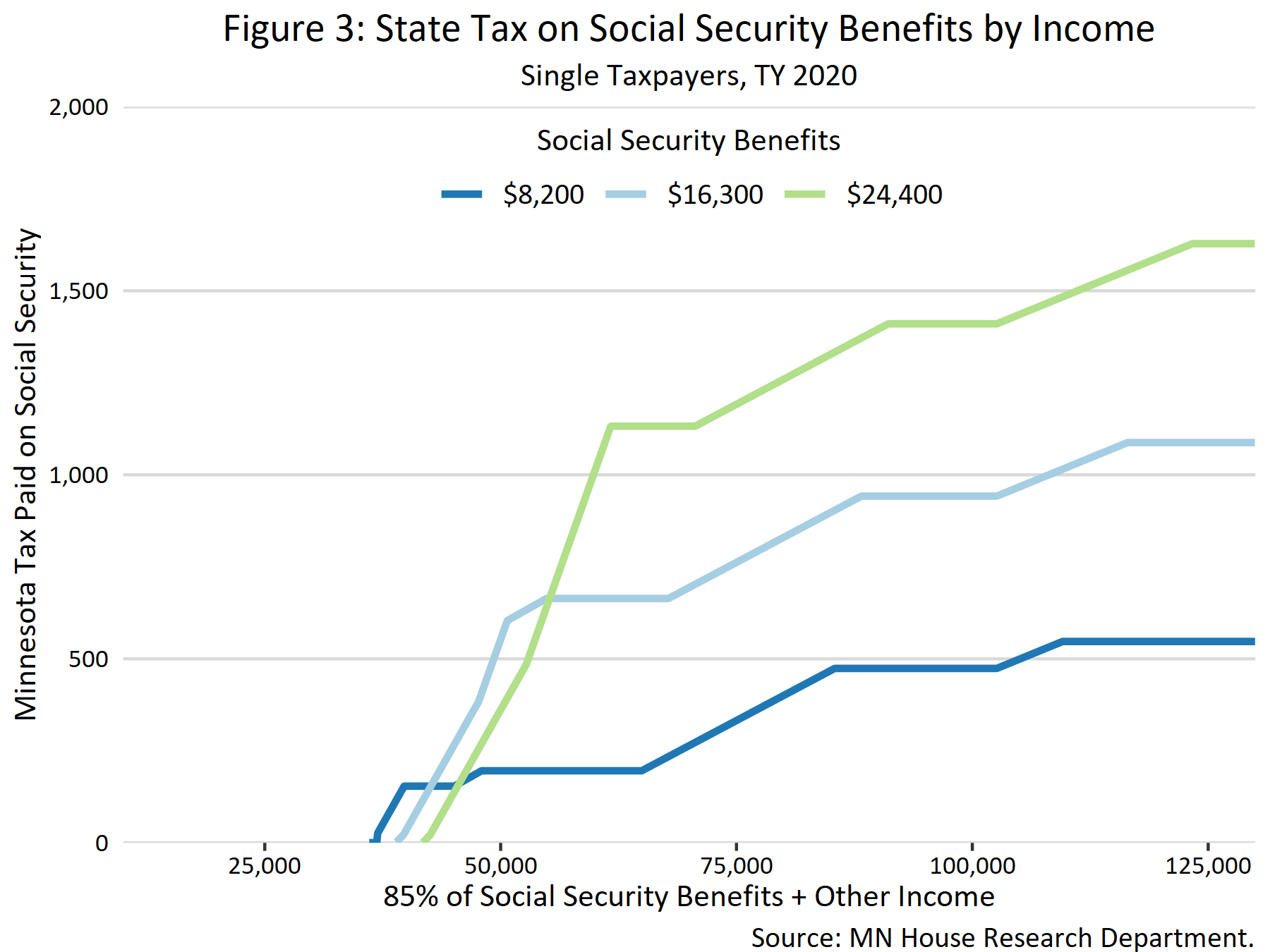

Taxation Of Social Security Benefits Mn House Research